Talk soon,

Thanks for reaching out. I’m looking forward to connecting with you to understand your needs and discover how I can serve you best.

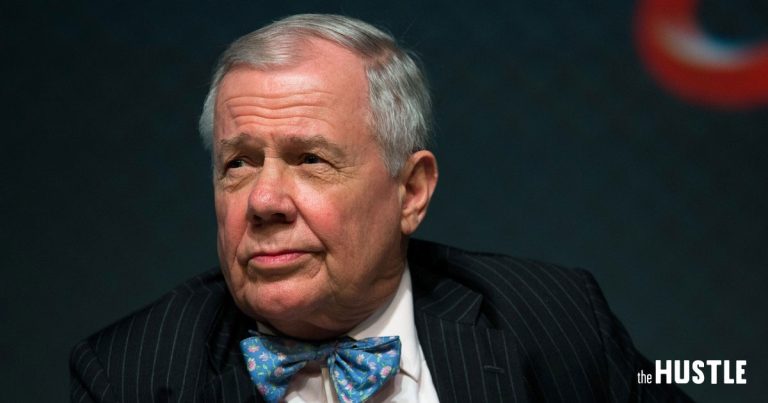

Famous for more than his colourful bowties, Jim Rogers is an investment guru and entrepreneur with an impressive track record of success in the financial industry.

Born on October 19, 1942, in Baltimore, Maryland, Rogers is widely known for his unconventional investment strategies and his insightful perspectives on global markets.

As a university-educated, sophisticated investor, financial expert, or professional advisor, you may already be familiar with Rogers’ investment principles and strategies. However, in this article, we will explore Rogers’ most famous deals, his investment philosophy, and some little-known trivia about the man behind the legend.

Investment Philosophy

Jim Rogers is a proponent of a long-term, value-driven investment approach that focuses on identifying undervalued assets and holding them for an extended period. Rogers’ approach is grounded in his belief that successful investors must think independently, avoid herd mentality, and have a deep understanding of the markets they invest in.

One of the core principles of Rogers’ investment philosophy is the importance of diversification. According to Rogers, diversification is crucial to managing risk, and investors should avoid putting all their eggs in one basket. As he famously said, “I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.”

Another key element of Rogers’ investment philosophy is his focus on macroeconomic analysis. Rogers believes that investors must have a thorough understanding of global economic trends and geopolitical risks to make sound investment decisions. As he once said, “I’ve learned that the best investment decision is always made with a clear understanding of the risks involved.”

Famous Deals

Jim Rogers’ investment career spans more than four decades, during which he has made some of the most significant investments in history. Below are some of his most famous deals.

Quantum Fund: In 1973, Jim Rogers co-founded the Quantum Fund with George Soros. The fund gained 4,200% in ten years, making it one of the most successful hedge funds of all time.

Commodities: In the late 1990s, Rogers became bullish on commodities and started investing heavily in the sector. He correctly predicted a commodities supercycle, which saw prices of commodities such as oil, gold, and copper skyrocket. Rogers’ commodities investments earned him significant profits, and he remains a vocal advocate of the sector to this day.

China: In 2004, Rogers moved to Singapore and started investing heavily in China. He believed that China’s growth would outpace that of the rest of the world and that investing in Chinese companies would be highly profitable. His investments in China included real estate, commodities, and stocks, and he became known as one of the most prominent China bulls.

Famous Quotes

Jim Rogers is known for his insightful and often controversial views on the financial industry and global markets. Below are some of his most famous quotes.

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.” This quote emphasizes Rogers’ belief in the importance of patience and his view that successful investors must be willing to wait for the right opportunity to present itself.

“The way to make money is to find something that’s cheap and then invest in it for a long time.” This quote highlights Rogers’ focus on value investing and his belief that successful investors must have a long-term perspective.

Little-Known Trivia

Despite his long and successful investment career, there are some interesting and little-known facts about Jim Rogers that are worth mentioning.

Rogers is a world traveller and has visited over 180 countries. He has written several books about his travels, including “Investment Biker: Around the World with Jim Rogers” and “Adventure Capitalist: The Ultimate Road Trip.”

Rogers is a vocal advocate of homeschooling and has been homeschooling his two daughters since 2007.

Rogers is an accomplished author and has written several books on investing, including “Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market” and “A Bull in China: Investing Profitably in the World’s Greatest Market.”

Conclusion

Jim Rogers is a true investment legend, known for his unconventional investment strategies, his contrarian approach, and his insightful views on global markets. His investment philosophy, based on value investing, diversification, and macroeconomic analysis, has proven highly successful over the years. His most famous deals, including his involvement in the Quantum Fund, his investments in commodities, and his bullish stance on China, have earned him significant profits and cemented his reputation as one of the most successful investors of all time.

His famous quotes and little-known trivia add depth to the man behind the legend and provide a fascinating insight into his personality and philosophy. As a university-educated, sophisticated investor, financial expert, or professional advisor, there is much to learn from Jim Rogers’ investment approach, strategies, and principles, which are as relevant today as they were when he first started his career in finance.

About the Author: Patrick Woodcraft

As a wholesale investment specialist, I help Certified Financial Planners and Qualified Financial Advisors with the information and education they need about investment funds that are poised to perform best for their clients through the volatile economic seasons ahead. Book a free 15 minute discovery call with me to see what value I can bring to your business and establish if we’re a good fit to work together.

HOW CAN I HELP YOU PROSPER THROUGH THE CHAOS

Thanks for reaching out. I’m looking forward to connecting with you to understand your needs and discover how I can serve you best.

*Patrick Woodcraft does not provide financial advice or investment advice. Nothing on this website may be construed as financial advice or investment advice. Past investment performance is no guarantee of future results.

© Patrick Woodcraft 2023