Talk soon,

Thanks for reaching out. I’m looking forward to connecting with you to understand your needs and discover how I can serve you best.

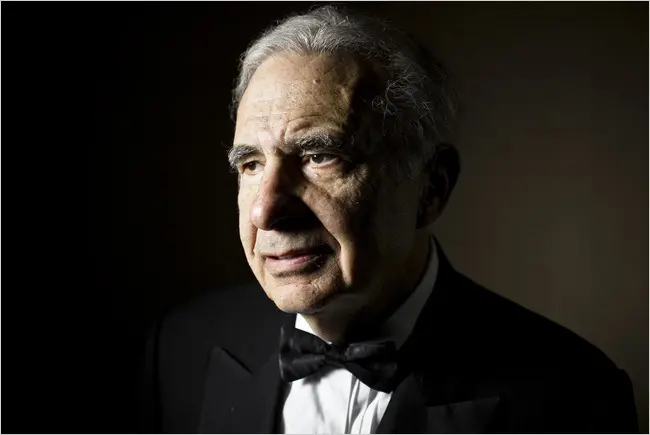

Carl Icahn, an American billionaire investor, is a legend in the world of finance. With a net worth of over $16 billion, he is one of the wealthiest people in the world.

Icahn’s investment strategies and principles have been the subject of much analysis and admiration. In this article, we will delve into the secrets of his success and explore some of his most famous deals. We will also share some little-known trivia about the man.

Icahn’s Investment Strategies and Principles

One of the cornerstones of Icahn’s investment strategy is his focus on undervalued companies. He seeks out companies that are undervalued in the market and then buys large stakes in them. He then uses his considerable influence to shake up the company, usually pushing for changes in management, mergers, or acquisitions. He has a reputation for being a “corporate raider,” but he prefers to be known as an “activist investor.”

Icahn’s approach to investing is based on his belief that the market is not always rational. He thinks that there are often opportunities to buy stocks at a discount, and he is willing to take a long-term view on his investments. He has famously said, “In a bull market, one must avoid the error of the preening duck that quacks boastfully after a torrential rainstorm, thinking that its paddling skills have caused it to rise in the world. This is a delusion bred by the upswing.”

Another key aspect of Icahn’s strategy is his willingness to take risks. He is not afraid to make big bets on companies that he believes are undervalued. He has also been known to use leverage to amplify his returns. However, he is quick to cut his losses if things don’t go according to plan. As he has said, “You learn in this business: If you want a friend, get a dog.”

Icahn’s Famous Deals

Icahn has been involved in many famous deals over the years. One of his most famous deals was his battle with Blockbuster in the early 2000s. Icahn was convinced that Blockbuster was undervalued and that its management was making poor decisions. He started buying up large stakes in the company and eventually won a seat on the board. He then pushed for changes in the company’s strategy, including a move towards digital distribution. While Blockbuster ultimately went bankrupt, Icahn made a tidy profit on his investment.

Another famous deal was his battle with Apple in 2013. Icahn believed that Apple was undervalued and that the company should return more cash to shareholders. He started buying up large stakes in the company and eventually met with Apple’s CEO, Tim Cook. After the meeting, Apple announced a $14 billion stock buyback, and the stock price soared. Icahn made a profit of over $2 billion on his investment in Apple.

Icahn has also been involved in the energy sector. In 2012, he bought a large stake in Chesapeake Energy, a natural gas company. He then pushed for changes in the company’s management and strategy, which led to a turnaround in its fortunes. Icahn made a profit of over $1 billion on his investment in Chesapeake Energy.

Little-Known Trivia About Carl Icahn

Despite his reputation as a tough businessman, Icahn is also known for his philanthropy. He has donated over $200 million to the Icahn School of Medicine at Mount Sinai in New York, which is named after him.

Icahn is also a keen poker player and has competed in high-stakes tournaments. He has said that poker is a good training ground for investing, as it teaches you to be patient and to make decisions based on incomplete information.

In addition to his philanthropy and love of poker, Icahn is also a passionate art collector. He has a collection of modern and contemporary art that is estimated to be worth over $1 billion. Some of the artists in his collection include Pablo Picasso, Willem de Kooning, and Roy Lichtenstein.

Conclusion

Carl Icahn is a master of the universe when it comes to investing. His focus on undervalued companies, willingness to take risks, and ability to shake up management have earned him a reputation as one of the most successful investors of all time. His famous deals with Blockbuster, Apple, and Chesapeake Energy are a testament to his investment acumen. However, there is more to Icahn than just finance. His philanthropy, love of poker, and passion for art show that there is a complex person behind the investor. As he once said, “The game of life is a lot like the game of poker. You have to play the hand you’re dealt, but sometimes you can bluff your way through.” Carl Icahn has certainly played his hand well.

About the Author: Patrick Woodcraft

As a wholesale investment specialist, I help Certified Financial Planners and Qualified Financial Advisors with the information and education they need about investment funds that are poised to perform best for their clients through the volatile economic seasons ahead. Book a free 15 minute discovery call with me to see what value I can bring to your business and establish if we’re a good fit to work together.

HOW CAN I HELP YOU PROSPER THROUGH THE CHAOS

Thanks for reaching out. I’m looking forward to connecting with you to understand your needs and discover how I can serve you best.

*Patrick Woodcraft does not provide financial advice or investment advice. Nothing on this website may be construed as financial advice or investment advice. Past investment performance is no guarantee of future results.

© Patrick Woodcraft 2023